Annual salary calculator with overtime

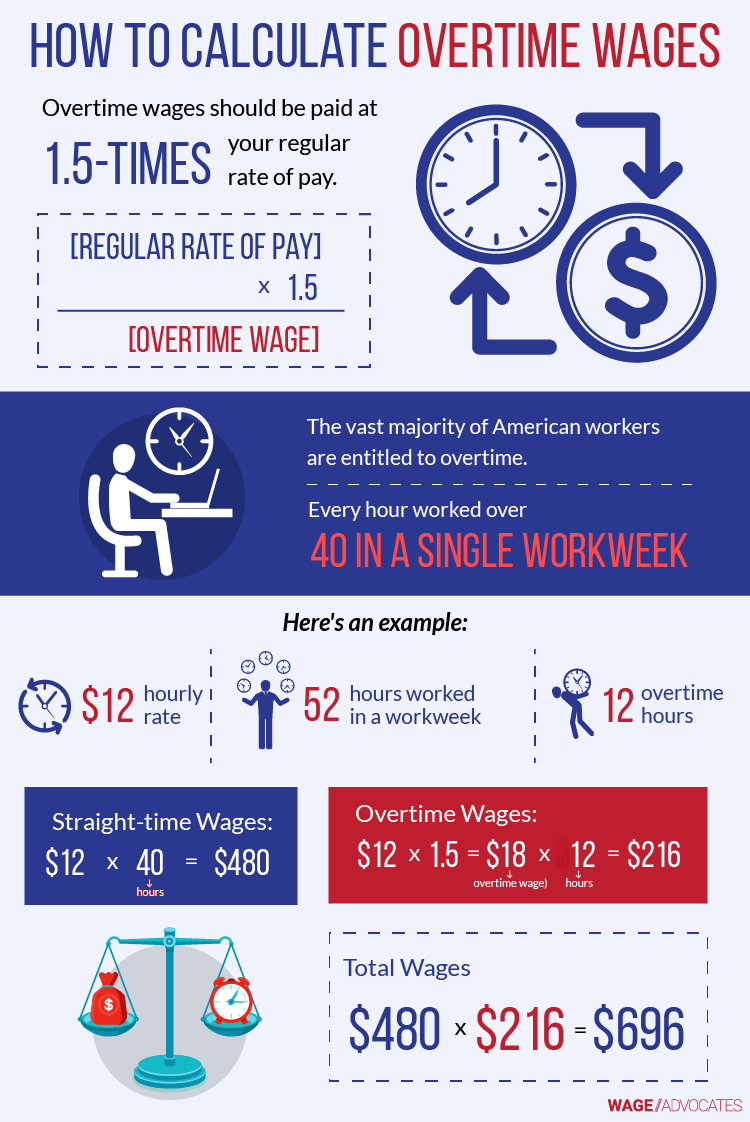

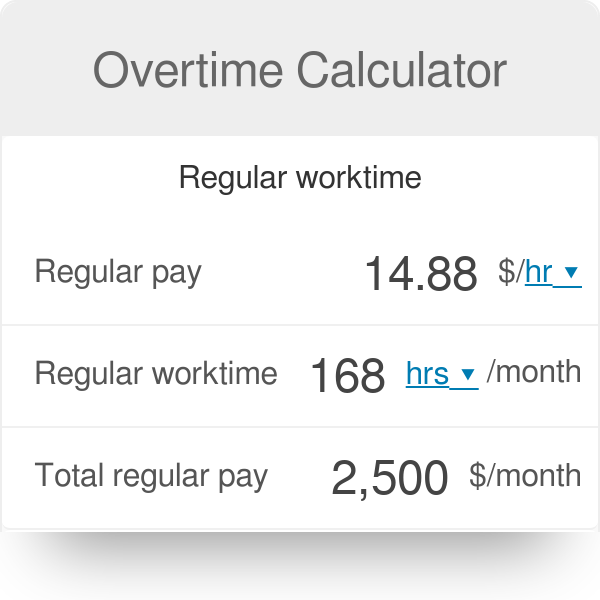

How to use the overtime calculator Input the employees annual salary. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15.

Hourly Income To Annual Salary Conversion Calculator

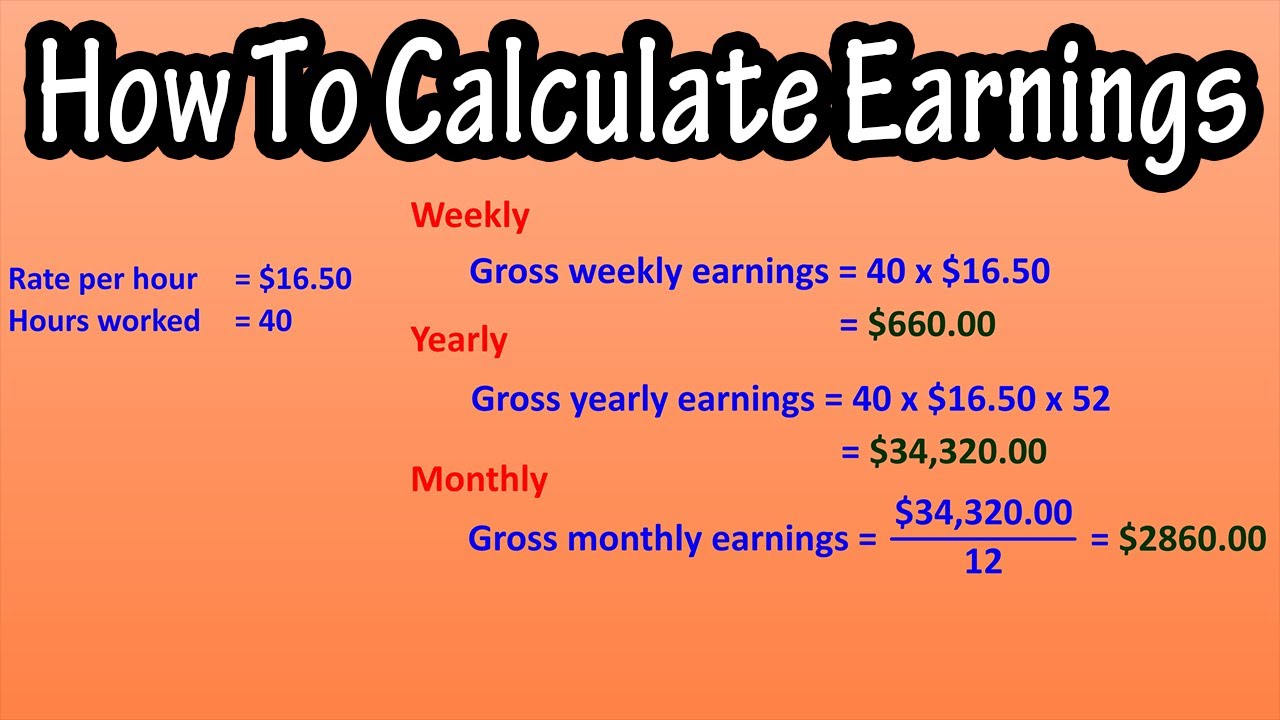

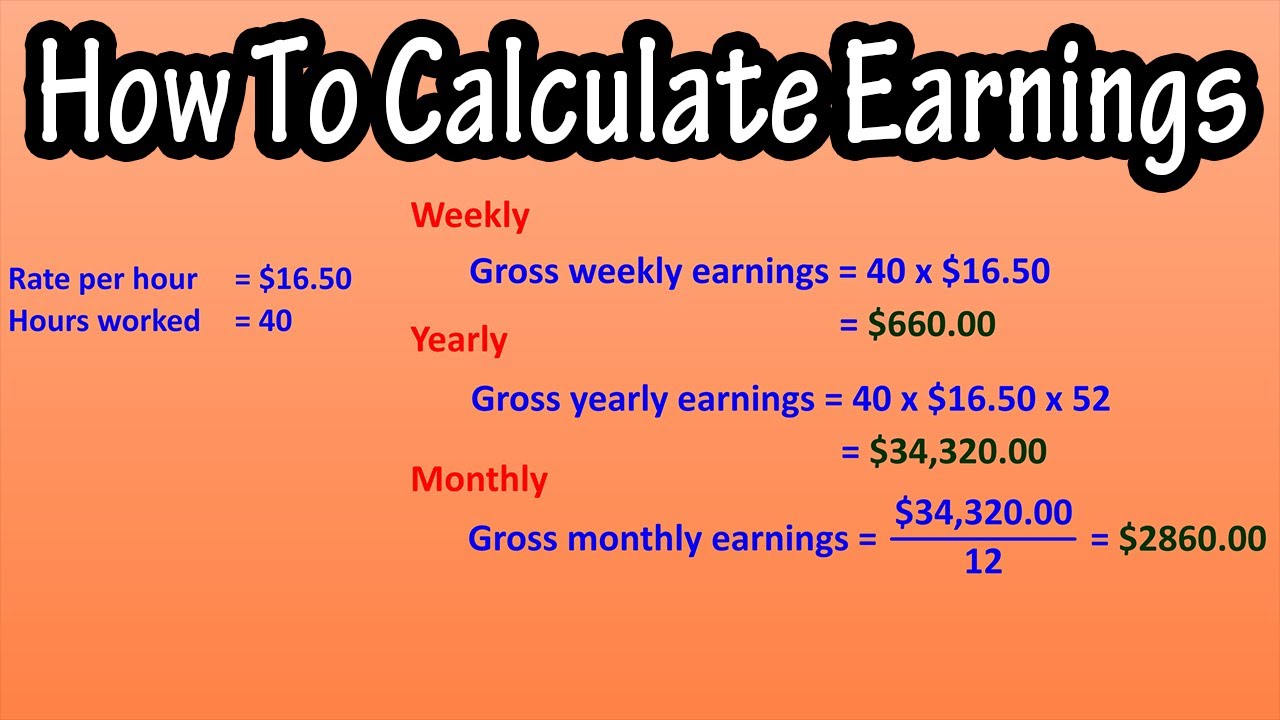

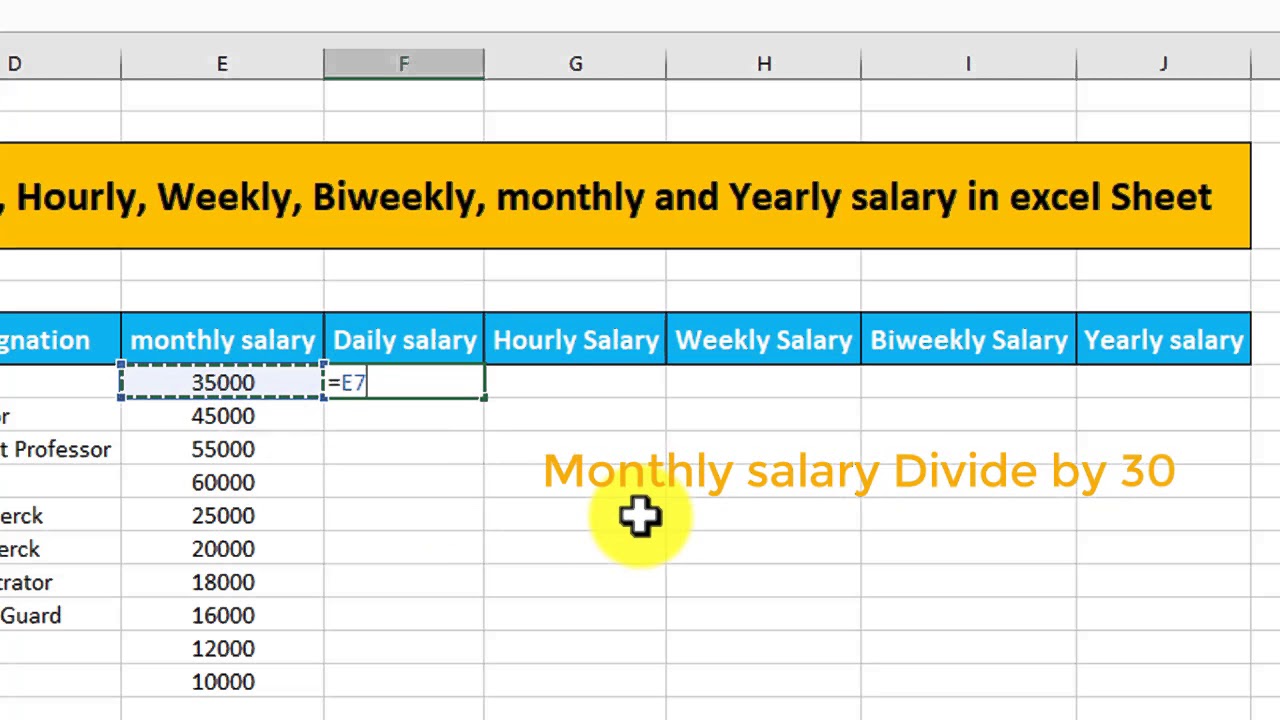

If that salary is paid monthly on the 1st of each month you can calculate the monthly salary by dividing the total salary by the number of payments made in a year to.

. Calculate the approximate number of hours. Calculate the number of hours you work per week by multiplying the hours you work per day by the number of days you work per week. To determine your hourly wage divide.

The Fair Labor Standards Act FLSA Overtime Calculator Advisor provides employers and employees with the information they need to understand Federal overtime requirements. Based on this the average salaried person works 2080 40 x 52 hours a year. To decide your hourly salary divide your annual income with 2080.

Use the following formula to calculate overtime pay for an hourly employee. Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. You can claim overtime if you are.

This limit has been recently increased to 684 from 455. 14 days in a bi-weekly pay period. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

The overtime calculator uses the following formulae. 365 days in the year please use 366 for leap years Formula. Annual salary with overtime calculator Jumat 09 September 2022 Edit.

The adjusted annual salary can be calculated as. 57 rows Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result.

1500 per hour x 40 600 x 52 31200 a year. So if an employee earns 40000 annually working 40 hours. The average full-time salaried employee works 40 hours a week.

Annual Salary Bi-Weekly Gross 14. Enter the number of paid weeks the employee works per year. 2084 x 10 overtime hours.

Overtime pay per period. In our example the result would be 40 hours 8. Calculating Annual Salary Using Bi-Weekly Gross.

Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week Overtime Pay Rate OTR Regular Hourly Pay. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. Based on a standard work week of 40 hours a full-time employee works 2080 hours per year 40 hours a week x 52 weeks a year.

35 hours x 12 10 hours x 15 570 base pay 570 45 total. As per the Fair Labor Standard Act FLSA An employee whose salary is below 684 per week is eligible for overtime pay. This employees total pay due including the overtime premium for the workweek can be calculated as follows.

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Hourly To Salary Calculator Convert Your Wages Indeed Com

4 Ways To Calculate Annual Salary Wikihow

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

How To Calculate Net Pay Step By Step Example

How To Calculate Wages 14 Steps With Pictures Wikihow

Overtime Calculator

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Overtime Calculator To Calculate Time And A Half Rate And More

Overtime Calculator Workest

How To Calculate Daily Hourly Weekly Biweekly And Yearly Salary In Excel Sheet Youtube

Hourly To Salary Calculator

Excel Formula Basic Overtime Calculation Formula

Annual Income Calculator Calculator Academy

Hourly To Salary Calculator

Overtime Calculator